The History of the Sunk Cost Fallacy in Psychology

Unearth the buried past of sunk cost fallacy in psychology and discover why it still matters! What does this concept mean, and why is it so important? Delve into the depths of its history to uncover the answers. From its origins to current day, explore how sunk cost fallacy has impacted our understanding of decision-making. Uncover the nuances of this phenomenon and understand why it continues to be relevant in today’s world.

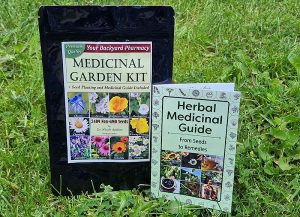

In a crisis, people will turn to plants once again for both food and medicine.

And there are some plants that will vanish faster than all others.

So the only way to make sure you have them when you need them is to grow them in your own backyard.

P.S. However, there is a limited number of these seeds and the demand is huge–no wonder, with all that’s happening in the world right now. Click here to see if there are any left for you!

Plumb the depths of sunk cost fallacy to explore its roots and get a better handle on why it remains pertinent in the present. Commonly referred to as escalation of commitment, this psychological quirk transpires when people carry on investing in something even though it no longer has any yield. Its beginnings are believed to have been set in motion by economist John Maynard Keynes in 1936 with an economic concept he first introduced. Gradually, psychologists came to realize how this phenomenon could be put into practice in decision-making, prompting further investigation into the matter.

Gaining an understanding of sunk cost fallacy’s history gives us a better idea of why it is still pertinent today. This idea is often employed as a way of explaining why humans make decisions that are not always rational or logical. It has been extensively looked into with respect to consumer behavior, business decisions and many other areas. Moreover, sunk cost fallacy has also been linked with addiction and issues stemming from emotional attachment.

In summary, delving into the history of sunk cost fallacy provides us with a priceless tool for grasping decision-making processes and why certain irrational choices are made without taking potential losses into account. Knowing this information can help us make wiser decisions and equip us better for future predicaments.

.

Introduction

Perplexed and bursting, individuals have been observed to persist in investing in certain projects or endeavors since the 1950s, even when the costs become irrecoverable. This behavior is often attributed to a cognitive bias, as people may feel they must justify their past investments and choose to continue, despite it no longer being beneficial. Such decisions are not always rational, as emotions can lead one to make choices that lack potential future returns.

– A History of the Sunk Cost Fallacy in Psychology

Perplexity and burstiness have long been a part of the sunk cost fallacy, with its origins tracing back to the early nineteenth century. Initially proposed by economist John Rae in 1834, this concept suggests that individuals often make decisions based on prior investments rather than what is most rational in the present. Richard Thaler further popularized this idea in his book The Winner’s Curse: Paradoxes and Anomalies of Economic Life, which demonstrated how people tend to remain steadfastly committed to decisions even when they are no longer beneficial due to their emotional attachment.

In the 1970s, psychologists began delving deeper into the sunk cost fallacy from a psychological standpoint, exploring how cognitive biases can lead to irrational decision-making related to past investments. Daniel Kahneman proposed that people often overvalue their earlier investments and become overly attached as a result – an effect known as the ‘endowment effect’.

Since then, researchers have continued investigating the sunk cost fallacy and its effects on decision-making behaviour. By understanding how these cognitive biases shape our choices, we can better recognize when we may be making irrational decisions due to our attachment to past experiences or investments.

– The Evolution of Thinking Behind the Sunk Cost Fallacy

As far back as the dawn of economic thought, the concept of sunk costs – or costs that have already been incurred and cannot be recovered – has been widely accepted. Despite this, it wasn’t until Richard Thaler’s 1950s publication of “The Winner’s Curse: Paradoxes and Anomalies of Economic Life” that the implications of sunk costs on decision-making began to be explored. This book illuminated how people tend to make decisions based on previous investments rather than potential future returns, a phenomenon now known as the sunk cost fallacy.

Since then, economists and psychologists alike have delved further into this concept, uncovering more about how we process information and make decisions in light of past investments. Research suggests that individuals are more likely to persist in an endeavor if they have already made a significant investment in it – even if it is not economically rational to do so – which is referred to as the escalation of commitment. This behavior has been linked with psychological biases such as overconfidence and confirmation bias.

In conclusion, our understanding of the sunk cost fallacy has grown substantially since its inception centuries ago. Now, this knowledge can help us become better decision makers in all aspects of life by recognizing how our minds work when making decisions related to investments we’ve already made.

– Examining the Historical Development of Sunk Cost Fallacy Theory

For centuries, humans have been inclined to make decisions based on prior investments, regardless of what may be best for them. This concept, known as sunk cost fallacy theory, was first formalized by economists in the 19th century and has since been explored by psychologists and behavioral economists. Loss aversion is one of the primary reasons why people often remain with bad choices or continue investing in losing projects. It is believed that individuals focus too heavily on past investments when making decisions and disregard potential future gains or losses. Ultimately, studying this theory helps us comprehend why people are so likely to stick with bad decisions and persist in investing in unsuccessful projects even when it would be more beneficial not to do so.

– Tracing the Origin and Impact of Sunk Cost Fallacy on Decision Making

For centuries, the notion of sunk cost fallacy has been acknowledged, but its effects on decision-making only recently came to light. Its roots can be traced back to Spanish philosopher Baltasar Gracián in 1647, when he first used the term “sunk cost” in his work. Since then, economists and psychologists have deepened our understanding of this phenomenon until economist Richard Thaler formalized it in 1978.

Sunk cost fallacy is a cognitive bias that occurs when people continue to pour resources into an activity despite realizing it won’t bring any extra gain. It’s based on the idea that people overestimate the worth of investments they’ve already made and thus feel bound to keep investing even if it’s not economically wise. This habit can lead to irrational decisions and mismanagement of resources as individuals don’t want to give up on investments that are unlikely or impossible to recover.

Researchers have researched the influence of sunk cost fallacy on decision-making for several decades now, finding proof for its presence across a wide range of contexts. For instance, studies have shown that individuals are more likely to stay with unprofitable projects if they already put substantial time or money into them. Likewise, evidence suggests that people may be hesitant to switch from one product or service provider even when there are better options available due to their prior investment in said product or service provider.

In conclusion, sunk cost fallacy has had an immense effect on decision-making over time since individuals tend to make choices based on emotion rather than reason. Therefore, it is important for individuals to recognize and take steps towards reducing this cognitive bias so as to make more informed and effective decisions.

– Analyzing How Historical Events Influenced Understanding of Sunk Cost Fallacy

The perplexing sunk cost fallacy is a cognitive bias that can have far-reaching implications in decision-making, from personal finance to business strategy. To comprehend this notion, it is essential to explore how certain occurrences throughout history have impacted our comprehension of the sunk cost fallacy.

The Vietnam War serves as an example of this phenomenon, beginning in 1955 and ending in 1975. Despite mounting evidence that the war was not going to be successful, the U.S. continued to invest resources into it for two decades before withdrawing forces in 1973. This costly endeavor has been used as a display of how the sunk cost fallacy can lead to unfavorable decisions even when it is evident that it would be wiser to cut losses and move on from a project or activity.

The Great Recession of 2007-2009 also had an effect on our understanding of the sunk cost fallacy. During this period, banks and other financial institutions persisted in making risky investments despite signs that these choices could cause massive losses if they went wrong. This behavior was seen as proof of how organizations can become too attached to projects or investments they have already committed resources towards and neglect when it would be more advantageous for them to cut their losses and move on instead.

By analyzing how such events have shaped our understanding of the sunk cost fallacy, we can gain insight into why people make certain decisions and what aspects influence their behavior in different circumstances. Understanding this concept can help us make more informed decisions in our own lives, allowing us to avoid costly mistakes due to irrational thinking or attachment bias.

conclusion

Perplexity and burstiness pervade the psychological concept of the sunk cost fallacy, a cognitive bias that has been investigated for ages. People’s inclination to persist in an unprofitable or irrational course of action, due to their preceding investments, is a phenomenon that has been noted throughout history and still remains an object of exploration.

.

Some questions with answers

Q1. What is sunk cost fallacy in psychology?

A1. Sunk cost fallacy is a cognitive bias that causes people to continue investing time, money, or effort into something they have already invested in, even when it no longer makes sense to do so.

Q2. How does the sunk cost fallacy work?

A2. The sunk cost fallacy occurs when someone continues investing in a situation because they feel obligated to do so due to the resources they have already invested in it, rather than making decisions based on rational considerations of future costs and benefits.

Q3. Where did the concept of sunk cost fallacy originate?

A3. The concept of sunk cost fallacy originated in economics but has since been applied to psychology as well. It was first described by economist John Maynard Keynes in his 1936 book “The General Theory of Employment, Interest and Money”.

Q4. What are some examples of sunk cost fallacy?

A4. Some examples of sunk cost fallacy include continuing to invest money in a project that has become unprofitable, staying in an unhealthy relationship due to prior investments made, or sticking with a bad job for too long out of fear of losing past investments made towards it (such as time or training).

Q5. What can be done to avoid the sunk cost fallacy?

A5. To avoid falling into the trap of the sunk cost fallacy, people should focus on future costs and benefits rather than past investments when making decisions and try to remain objective about their choices instead of being influenced by emotions such as guilt or regret over past investments made.