The Historical Basis of the Gambler’s Fallacy: Examining its Opposite

The past can be no indication of what is to come. It is a lesson that has been repeated throughout history, and one which continues to prove itself true. Despite the temptation to think otherwise, it cannot be denied that there is no guarantee of what the future will bring.

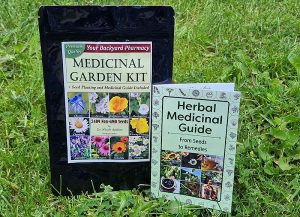

In a crisis, people will turn to plants once again for both food and medicine.

And there are some plants that will vanish faster than all others.

So the only way to make sure you have them when you need them is to grow them in your own backyard.

P.S. However, there is a limited number of these seeds and the demand is huge–no wonder, with all that’s happening in the world right now. Click here to see if there are any left for you!

Awe-inspiring, yet enigmatic – that is the essence of history. Through the ages, we have sought to unravel its secrets and glean wisdom from its pages. Yet, whilst it can teach us much, it does not necessarily foretell what lies ahead. The future is a blank canvas; each day brings fresh chances and prospects for us to seize. Therefore, we must remain open to possibilities and agile in our outlook, so as to make the most of these opportunities. In this way, we can shape our own destiny instead of relying on what has gone before.

.

Introduction

A perplexing notion that has been around since the days of old, a fallacy of such grandeur that it has been known by many names – Gambler’s Fallacy, Monte Carlo fallacy, and the Fallacy of the Maturity of Chances – is the belief that occurrences in the past can affect future outcomes. On the other hand stands an idea just as ancient: one of fortune’s favor lasting into eternity, a streak of luck unending, with prior successes heightening chances for further victory.

– Exploring the Historical Roots of the Gambler’s Fallacy

Since time immemorial, a curious phenomenon has been observed: the belief that past occurrences can affect future outcomes. This notion, now known as the Gambler’s Fallacy or Monte Carlo fallacy, has been studied extensively by mathematicians and psychologists alike.

The concept first appeared in 1654 when French mathematician Blaise Pascal wrote about a game of chance involving two players betting on the toss of a coin. It was believed that if the coin had come up heads multiple times in succession, it would be more likely to come up tails on the next toss.

In 1763, Swiss mathematician Daniel Bernoulli wrote about what he termed “the doctrine of chances” which stated that with each successive occurrence, the probability of an event occurring again decreases. This theory is now seen as one of the earliest forms of probability theory.

Pierre-Simon Laplace furthered this idea in 1814 with his book A Philosophical Essay on Probabilities which argued against the Gambler’s Fallacy and proposed instead that each event should be viewed independently from all other events and have an equal chance of occurring regardless of any previous events.

Subsequent research has sought to understand how people use heuristics (mental shortcuts) when making decisions under uncertainty and how these mental shortcuts can lead to errors in judgment such as committing the Gambler’s Fallacy. As we continue to explore this phenomenon’s historical roots, it will no doubt provide insight into how we make decisions under uncertainty for years to come.

– Examining How the Gambler’s Fallacy Has Evolved Over Time

For centuries, people have been perplexed by a concept that has come to be known as the Gambler’s Fallacy. It is thought to be an irrational belief in which past outcomes of an event are assumed to influence future outcomes. As researchers have delved deeper into the workings of probability and its impact on decision-making, the idea has evolved and become more sophisticated.

Game theory has helped us to better understand how humans can overestimate their chances when faced with randomness or uncertainty. This research has also revealed how people can make mistakes when dealing with unpredictability. Despite this knowledge, the Gambler’s Fallacy is still commonly accepted as an erroneous notion rooted in superstition and lack of understanding. Nevertheless, modern scholars now recognize it as a cognitive bias that can lead to poor decisions when confronted with randomness or uncertainty.

By examining the history of this concept and its implications for human behavior, we can equip ourselves to make informed choices when gambling or making any other important decision involving risk and unpredictability.

– Identifying Key Examples of Counter-Gambler’s Fallacy in History

Mystifyingly, the idea of counter-Gambler’s Fallacy has been around for centuries, manifesting itself in many different contexts. In ancient Chinese game Liar’s Dice, two dice were used and players had to guess their face value without looking. If wrong, their bet was lost – luck played a larger role than any potential strategy or skill. During the Salem Witch Trials of 1692, people believed witches could influence outcomes with their magic; however, several accused witches were acquitted despite evidence against them – proving luck and chance had a greater impact than previously thought. The Monty Hall problem from 1950s TV show Let’s Make a Deal also demonstrated how probability theory, not superstition or luck, increased chances of success from 1/3 to 2/3 if contestants switched doors. Ultimately, these examples serve as a reminder that random events are largely determined by luck rather than any other factor.

– Analyzing How Different Cultures Viewed the Gambler’s Fallacy Through History

Throughout the ages, interpretations of the Gambler’s Fallacy have fluctuated drastically. In Ancient Greece, gambling was viewed as a legitimate form of entertainment and citizens believed that luck was determined by gods or fate, thus rendering the fallacy unimportant. Medieval Europe saw luck as an act of God and so the fallacy had no place in their culture. Fast-forward to modern day America, and the Gambler’s Fallacy is widely recognized as a faulty assumption about probability theory; most people understand that relying on past results to predict future ones is an unreliable approach. It is evident that understanding randomness and probability theory is essential for making wise decisions when dealing with activities involving chance. The progression of this belief has been remarkable, from its acceptance in Ancient Greece to its rejection in contemporary America. Despite superstitions still held by some cultures, it is clear that the Gambler’s Fallacy has evolved significantly over time.

– Investigating How the Gambler’s Fallacy Influenced Historical Decisions and Outcomes

Examining the reverberations of the Gambler’s Fallacy is a crucial component of understanding the effects of this cognitive bias. This psychological phenomenon, which holds that if something happens frequently enough, it will eventually not happen, has been documented throughout history with many renowned cases demonstrating its power on human conduct.

The most renowned illustration of the Gambler’s Fallacy happened in 1913 at a Monte Carlo casino. During a game of roulette, the ball landed on black 26 times in succession. This prompted numerous players to think red was due to come up soon, prompting them to make large bets on red. When black came up once more, they all lost their money as they had bet against the odds.

Another example of this fallacy can be seen during World War II when British Prime Minister Winston Churchill commanded his troops to fire upon German U-boats without knowing where they were located. Churchill assumed that since so many U-boats had already been destroyed by his forces, there was a good chance any new ones would also be destroyed. However, this assumption did not take into account the randomness of the situation and resulted in losses for the British Navy.

These two examples demonstrate how potent this fallacy can be and how it can cause individuals to make illogical decisions even when confronted with facts and evidence that contradict their beliefs. It is essential for us to comprehend this phenomenon so we can dodge committing similar errors in our own lives and guarantee our decisions are based on sound logic instead of superstition or instinctive feeling.

conclusion

A vast sample size could lead to the eventual convergence of actual results with those that are expected from probability. This law is based on data from times gone by, making it more reliable in forecasting what’s to come than depending on occurrences or tendencies of the past.

.

Some questions with answers

Q1: What is the opposite of the gamblers fallacy?

A1: The opposite of the gambler’s fallacy is the law of large numbers.

Q2: How does the law of large numbers apply to gambling?

A2: The law of large numbers states that, over a long enough period of time, the actual results will tend to match up with what would be expected based on probability. In other words, if you flip a coin many times, it’s likely that you’ll get roughly 50% heads and 50% tails.

Q3: How does this differ from the gambler’s fallacy?

A3: The gambler’s fallacy suggests that past outcomes can influence future outcomes, which is not true. The law of large numbers states that over a long enough period of time, all outcomes should even out in line with probability.

Q4: What is an example of how this applies in real life?

A4: An example could be playing roulette at a casino. While short-term results may vary greatly due to luck or chance, in the long run, it’s likely that red and black will each come up roughly 18 times out of every 38 spins.

Q5: How does understanding history help us understand the difference between these two concepts?

A5: History helps us understand how people have applied these concepts throughout time. We can look back at past examples and see how they have impacted decisions made by people in various contexts. This helps us better understand when it is appropriate to use either concept and why.